After clamping down on domestic trading of cryptocurrencies, China is looking to do the same to international crypto trading by its citizens. According to a news report in the South China Morning Post, a government-run publication, China will “step up” measures to remove offshore platforms for virtual currency trading or ICOs. In other words, the government there plans to restrict its citizens from trading in cryptocurrencies at overseas exchanges or participating in initial coin offerings held abroad.

China’s government banned cryptocurrency exchanges from conducting operations within its borders last year. (See also: China's Cryptocurrency Exchanges Are Officially Dead). As a result of that decision, several crypto exchanges based in the country relocated to neighboring jurisdictions or began servicing foreign customers. While exact figures are unavailable, the ban does not seem to have had a significant effect on trading. (See also: China's Cryptocurrencies Have Gone Underground.)

Domestic customers began trading on the new exchanges by using virtual private networks (VPNs) that enabled them to bypass government-controlled gateways and connect to exchanges in Hong Kong, Japan and South Korea. All three locations regularly account for the largest trading volumes for cryptocurrencies. In fact, Hong Kong-based Binance has emerged as one of the top three exchanges in the world by trading volume. It was also reported to be adding 200,000 users every hour.

While exact figures related to trading by Chinese citizens are unavailable, the government-controlled publication provided an indicator of the extent of the problem. According to the publication, “many people turned to overseas platforms to continue participating in virtual currency transactions” after the ban. “Risks are still there, fueled by illegal issuance and even fraud and pyramid selling,” the article stated.

China’s decision to further impose controls on cryptocurrencies comes amid a wider worldwide crackdown on the asset class. South Korea is said to be considering regulation even as Japan is tightening the leash on exchange operations following the Coincheck hack. China exerts a significant influence on bitcoin prices through its plethora of trading operations and miners. (See also: Are Bitcoin And Crypto Prices Totally Dependent On China?)

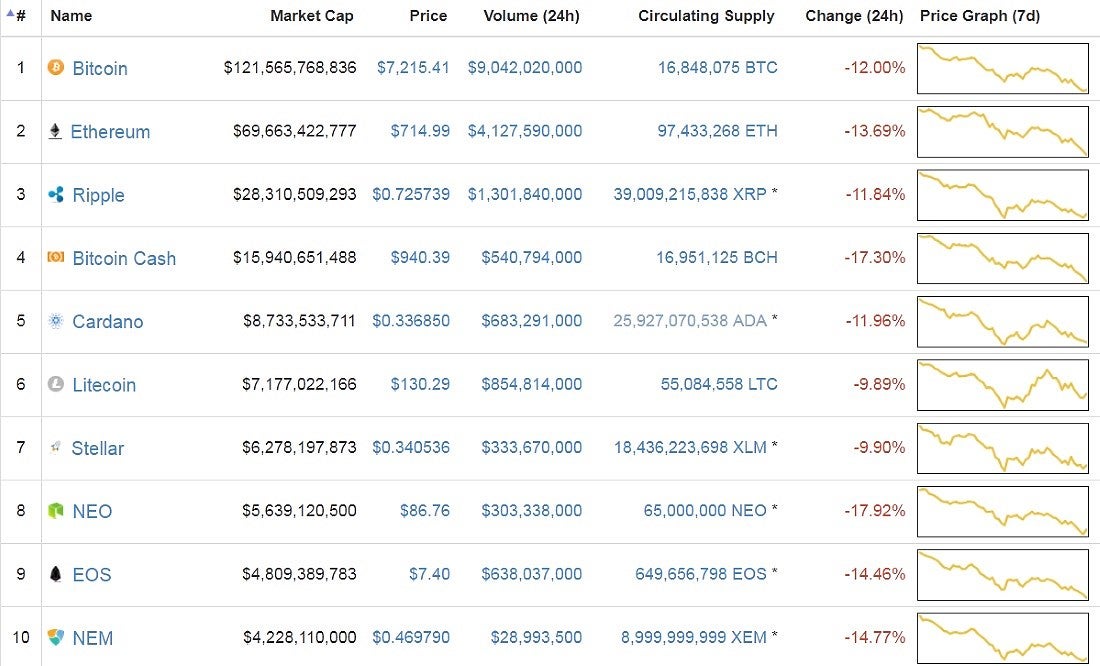

According to the South China Morning Post article, the country's move will benefit Japanese and South Korean exchanges as investors will move their trading operations to take advantage of volatility in cryptocurrency trading. Cryptocurrency markets have reacted to the threat of increased regulation with a prolonged slump. Approximately $60 billion in value was knocked off the markets over the weekend. (See more: Bitcoin Price Falls Below $8,000, Down 42% Since Start of the Year.)

Investing in cryptocurrencies and other Initial Coin Offerings ("ICOs") is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. As of the date this article was written, the author owns small amounts of bitcoin.

Read more: China To Crack Down On International Cryptocurrency Trading By Its Citizens | Investopedia https://www.investopedia.com/news/china-plans-crack-down-international-cryptocurrency-trading-its-citizens/#ixzz56LYOPfNO

Follow us: Investopedia on Facebook

No comments:

Post a Comment