Dear Reader,

Consider the following investment scenario for a moment...

Around the 15th of this month, you receive a recommendation from Equitymaster for a relatively unknown and under-researched small cap stock.

This stock may not be talked about much in the media, your stock broker may not have enough information on it, and it may not be the focus of any discussion with friends.

But still, largely because it is Equitymaster that's recommending the company, you decide to play it safe and invest a tiny-winy portion of your money in it. You know, just in case.

And then, silently the company continues to grow behind your back.

As you grow older, the company also grows old with you... moving up in value and price -- doubling, tripling, and quadrupling during this period.

Then one day in the not so distant future, when you've probably even forgotten that you own shares of this "once unknown" company, it surfaces as one of the leaders in its industry...

Handing You Returns Of

1,000% or More Effortlessly!

Is something like this really possible?

Yes, it certainly is!

In December 2004, Cera Sanitaryware Ltd. was a little known small cap stock available for just Rs 16.4 a share.

Not many people expected it to grow the way it has, and therefore not many bothered to invest in it.

But by cashing in on the increasing demand for stylish high-end bathroom fittings, and coming up with a business model that set it apart from all its competitors, the company succeeded in growing its business rapidly.

As a result, its stock price increased from Rs 16.4 in 2004 to Rs 1,779.7 in December 2014. And those who invested in Cera Sanitaryware in 2004 ended up making a whopping 10,785% on it till 2014.

So if you had invested just Rs 10,000 in it in 2004, it would have been worth Rs 1,088,500 by 2014!

And this is not a one-off case either. Take a look at the table below...

Change in share prices over 10 years

| Company | Dec-04 | Dec-14 | Change |

|---|---|---|---|

| Mayur Uniquoters Ltd. | 1.5 | 428.7 | 28,174% |

| Ashiana Housing Ltd. | 1.0 | 198.9 | 20,370% |

| Kitex Garments Ltd. | 2.8 | 510.1 | 17,923% |

| Rollatainers Ltd. | 3.7 | 460.0 | 12,372% |

| La Opala RG Ltd. | 3.7 | 453.9 | 12,334% |

| Hawkins Cookers Ltd. | 33.6 | 3,687.1 | 10,890% |

| Cera Sanitaryware Ltd. | 16.4 | 1,779.7 | 10,785% |

| Butterfly Gandhimathi Appliances Ltd. | 2.5 | 221.8 | 8,770% |

| Atul Auto Ltd. | 7.7 | 675.7 | 8,725% |

| Vinati Organics Ltd. | 5.7 | 430.1 | 7,507% |

Now before we proceed, let me clear one thing:

And later on in this letter, I will actually share with you some small cap stocks that WE recommended, and how well they've done.

But getting back to the original point...

What was the common thing in all these small companies

that set up huge profit windfalls for their investors?

Though not many people knew, all these companies were already leaders in their own sub-niche or the small area of the industry they operated in.

And thus, they were much better prepared than their peers for managing explosive growth in the years to come.

So when the demand for their product grew, they were able to provide a much better service than all of their competitors and quickly established themselves as the go-to guy in their niche.

And the rest as they say, is history.

It's true! Most of the companies you saw in the table above are pretty well known in India today. But at one time they were not so well known.

They all started out small, established themselves as the leader in one main area where their expertise lay, and then diversified into other areas.

Imagine how much you would make if you found out all such high-potential small companies early, and invested in them while they're still in their infancy?

Given the uncertain nature of small caps, we cannot and should not expect every small cap stock to be an out-and-out winner.

But we know that small caps are fast movers, and that the movement quickly shows in their stock price.

So assuming you manage to pick 5 'reliable' small cap stocks, even if just 3 out of the 5 manage to endure the market uncertainties and turn multi-baggers, you will be rich!

And that is what our small cap recommendation service, Hidden Treasure, aims to help you do.

Grab Reliable, High Potential Small Companies

For Ridiculously Low Valuations

Did you ever find yourself thinking, "I wish I had invested in Titan while it was still young?" Or even in Pidilite for that matter?

These were once-unknown-small companies that have grown rapidly in the last decade to become household names in India today.

But there was no way you could have known that sooner... until now...

Through Hidden Treasure we're providing you opportunities like that today.

The stocks we reveal through Hidden Treasure are companies that are either under-researched or not covered by other stock brokers and research firms.

There's no other authentic source of LONG-TERM recommendations on such companies. And whatever else is available is biased.

I understand that small caps may not comprise a big portion of your portfolio. But that doesn't mean you don't need to think about them at all.

This small part of your portfolio does the KEY job of maximizing your returns...

That's Why You Need To Be EVEN MORE Careful

In Choosing Your Small Cap Stocks

The stocks we recommend through Hidden Treasure are strong companies and we recommend them not because we believe they will flourish in a month or two, but over a minimum period of 4 to 5 years.

We reveal reliable small companies through Hidden Treasure as and when they're available at a bargain... giving you the opportunity to snap them up early and set yourself up for huge gains when these stocks soar.

However, considering the risks that small companies carry, you should realistically not expect each and every recommendation to be an out and out winner.

Plus, whenever the market crashes, small caps are the first to bear the brunt of it.

So these are some things you need to understand and acknowledge when you invest in small caps.

But despite all these drawbacks, we believe our Hidden Treasure service has actually done quite well.

Our 7-Year Hidden Treasure experience

It was on 15th February, 2008... i.e. a little over 7 Years back, that we picked out our first Small Cap Stock.

After much deliberation, in-depth research and testing it across multiple factors... we found it to be an excellent opportunity.

So we recommended a select group of investors to Buy it, and monitored it for them constantly.

Keeping them updated on its performance. Ensuring that our assumptions were right and the company was strong on its growth path.

The efforts paid off!

Our First Small Cap Stock recommendation gave our subscribers an impressive 93% return in 2 years 6 months.

A quite satisfactory beginning to many more successful small cap picks in the years to come.

On the whole, our 2008 stock picks gave our subscribers returns like:

| Returns Booked | Investment Period |

|---|---|

| 250% | In 2 Years |

| 110% | In 2 Years 4 Months |

| 93% | In 1 Year 8 Months |

| 217% | 3 Years & 11 Months |

After that...

| We saw many more smart investors joining our small cap recommendation service and benefitting from our research. | |

| We saw our research team spending many more hours scrutinizing obscure but fundamentally strong small caps. | |

| We had teams visiting various cities across the country, meeting various management teams and picking out even more profitable small cap picks! |

And the same good trend continued in 2009 also... despite both these years witnessing some of the biggest market crashes.

That's right!

So, even from our 2009 picks, we saw many exciting returns like:

| Returns Booked | Investment Period |

|---|---|

| 288% | In 2 Years & 5 Months |

| 124% | In just about 7 Months |

Our subscribers were ecstatic! And the Market was exciting.

The year 2010, on the other hand, turned out to be tumultuous for the entire small cap index. And our subscribers too couldn't escape its effects.

But starting 2011, we were back to booking profits again...

| From our 2011 stock picks, we booked profits like 139% in 7 months, 100% in 1 year 1 month, 82% in 1 year 2 months, 241% in 3 years 3 months and 140% in 4 years. | |

| Further, from 2012 picks, we have booked returns like 123% in 3 months and 166% returns in 2 years to name a few. | |

| Coming to our 2013 picks, believe it or not, ALL of our 2013 Buy Recommendations have given at least double-digit returns till now! And we have closed 3 positions recommended in 2013 with not just double but triple-digit returns. | |

| And what about 2014? Well, these are still early days to talk about the 2014 recommendations, but 3 of them have already given 126% in 11 months, 79% in 4 months and 133% in 1 year 3 months. |

So the service has performed well over time and today, it's One Of Our Most Popular Services!

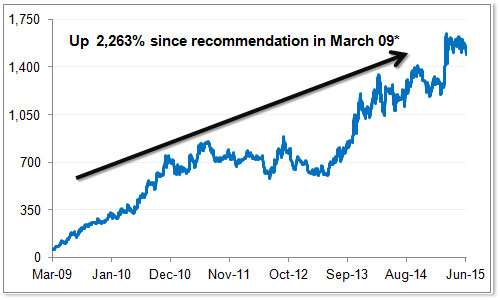

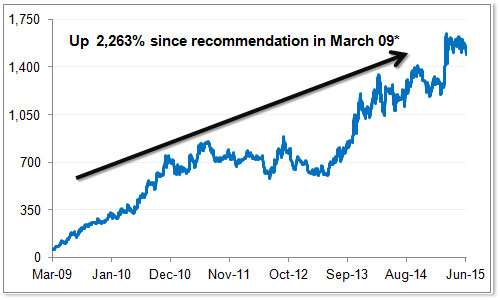

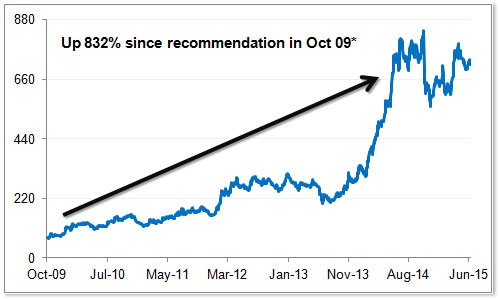

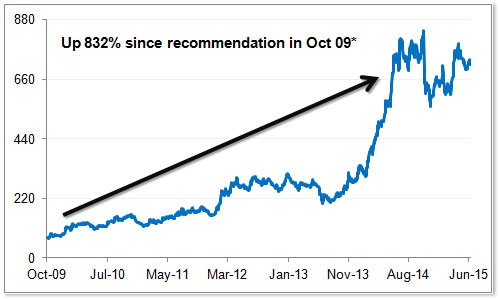

In fact, one of our best recommendations, eClerx Services, has given an amazing return of 2,263% in 6 years and 3 months... and another,Balkrishna Industries, has given 832% in 5 years 8 months...

And they are both still not closed too!

eClerx Services Past performance does not guarantee future results.

Past performance does not guarantee future results.

*Returns have been calculated with respect to 30th June 2015

Past performance does not guarantee future results.

Past performance does not guarantee future results.*Returns have been calculated with respect to 30th June 2015

Balkrishna Industries Past performance does not guarantee future results.

Past performance does not guarantee future results.

*Returns have been calculated with respect to 30th June 2015

Past performance does not guarantee future results.

Past performance does not guarantee future results.*Returns have been calculated with respect to 30th June 2015

So with thousands of subscribers and a solid track record... we can confidently say that our research process works!

But at the same time, we don't want you to get the wrong picture.

Not all Small cap stocks will jump up too much... too quickly!

However, the most important thing is that even if 3 out of every 5 small caps eventually manage to endure the market uncertainties and turn multi-baggers, you will be rich!

And that is what we want to help you achieve through our Hidden Treasure service.

Take a look at some more of the returns made by our Hidden Treasure recommendations:

| Stock Recommended | Change |

|---|---|

| Nitin Fire Protection Ind. | 139% in 7 months |

| Elgi Equipments | 250% in 2 Years |

| KPIT Cummins Infosystem | 288% in 2 years & 5 months |

| V-Guard | 123% in 3 months |

| Page Industries | 4,392% in 6 years 2 months (and still not closed) |

It's for this reason that Hidden Treasure has been One Of Our MOST POPULAR services over the last couple of years.

And we want YOU also to be one of the people to benefit from it.

So today, we have got something Extra Special for you. . .

See, the usual price of Hidden Treasure is Rs 5,000 per year.

But for the next few days, you can get Hidden Treasure at More than 60% Off... or Just Rs 1,950 for a One Year Subscription.

And then, there's also a 30-day, 100% moneyback guarantee on this offer.

So, you can sign up at this price and test-drive Hidden Treasure for a full 30 days.

If you don't like it, get in touch with us before the 31st day, and we'll refund the entire fee you paid. That's a promise!

But you must act quickly.

This offer will close soon, and then you will have to pay the FULL price to sign up for Hidden Treasure.

Here's What All You Get

By Subscribing to Hidden Treasure. . .

Equitymaster analysts have to go through many more hoops to find the few small cap gems that exist.

And since it's OUR reputation at stake here, we also have to meet with the managements of different companies and organise trips to various cities every month to make sure we're accurate in our predictions.

All this takes time, and therefore just the one new recommendation per month.

But in addition, every month we will also publish the Top Small cap stocks you could buy at that point.

Plus, you also get:

- Quarterly results review of all Open Hidden Treasure recommendations

- Performance review every month in our report

- Special updates on the recommendations as and when required

Why you can trust us to deliver . . .

We've been in this industry for a LONG time. In fact, we were the first Indian entity in the finance domain to venture onto the Internet.

And now, we have completed over 19 years online.

Today we have over 1,484,807 members from 71 countries worldwide who trust us!

But at the same time, we are NOT stock brokers. We don't gain anything even if you buy the stocks we recommend.

However, almost all of our income comes from the fee we charge on our stock recommendation services. And so it's extremely important to us that the stocks we recommended make you money.

That's why...

- All our recommendations are supported by thorough research - we list out the reasons to buy and also the investment concerns that we foresee.

- We travel far and wide to meet companies before we put out reports on them

- For each stock, we clearly state the rationale behind selecting that stock, the target price and also the time horizon for achieving the same.

- And finally, because we meet various companies face to face, ask tough questions and continuously track our recommendations... we reduce the risk of a Satyam like situation emerging in stocks that we recommend.

Here's what one subscriber had to say about our research...

Another reason why our research turns out to be

accurate more often than not . . .

You see, most investors take the return on stock investment to be the key yardstick while deciding whether or not to buy a stock.

But legendary investors like Benjamin Graham and Warren Buffett have always maintained that 'evaluation of risks' should be given as much importance as 'estimation of returns'.

It is in this direction that our research team has developed the Equitymaster Risk MatrixTM or ERMTM which helps quantify the risk attached to a stock. The ERMTM is an integral part of our stock selection process.

Look, we all know that no two large, mid or small cap companies have exactly the same degree of risk. Even if they operate in the same sector, their business dynamics, managements and valuations are different.

That's why it is important to evaluate the risk involved in each case separately.

Now the ERMTM is a matrix designed to evaluate the key risks attached to a business, it financial history and its management. It ranks not just the company but also the sector in which it operates based on its relative risk profile.

How the ERMTM made and saved

our subscribers money. . .

When markets were at their nervous best in late 2008 and early 2009, our Buy recommendations on Page Industries, eClerx, and KPIT Cummins were backed by our confidence in the low risk profile of these companies as shown by our risk matrix.

As expected, these stocks went on to multiply our subscribers' wealth several times.

Over the years, this original risk matrix has been refined further into the ERMTM we have today.

Many a time, the ERMTM helped us identify the best stocks to recommend to our subscribers when several of them were looking attractive.

It did so by acting as one of the tools used for eliminating the bad stocks, so that we recommend only the good stocks.

But that's not all...

Again, it is the same ERMTM that we rely on to quantify the risks we believe subscribers need to be cautioned about while recommending a 'Sell'.

Given the complex operating environment that Indian business are aspiring to be a part of, we believe the ERMTM can offer immense value to investors seeking to maximize their long term returns by without taking on too much risk.

But I won't lie to you -

Sometimes we make mistakes too

Like we made a mistake in recommending MIC Electronics in July 2009...

The key reason for our belief in the company was its prominent presence in the fast growing LED lighting space, where it is a market leader in India. The company had grown strongly in the past and its balance sheet also appeared good.

However, despite our good expectations, the company failed to capitalise on the growth opportunity. In fact, it lost a major order from one of its key clients.

Then, we also had some issues with the company's disclosure levels.

Over that, the management's silence on the several issues facing the company had been deafening.

Given this, we recommended our subscribers to sell the stock, at a loss of 45% from our recommended price.

And apart from MIC Electronics, there were some other companies also that did not do as per our expectations and closed at a loss like:

| Company name | Loss % |

|---|---|

| SREI Infrastructure Finance Ltd. | -71% |

| Ahluwalia Contracts (India) Ltd. | -60% |

| Bartronics India Ltd. | -32% |

| Innoventive Industries Ltd. | -83% |

But what these incidents have done is that they have made us even more careful now with respect to our Hidden Treasure recommendations.

So like I said initially, you can't expect every small cap stock you invest in to be a winner. But even if a few of them succeed in enduring the ups and downs and turn multi-baggers, you'll make back whatever you lost in the other stocks... plus a lot more!

Okay?

And here's what else you get by subscribing to Hidden Treasure...

Easy-Access "Installable" Version of

Equitymaster's Stock Market Yearbook

Every year, we publish the latest and exhaustive data on Top 300 companies. Plus, a wealth of information on over 20 sectors, the Indian economy, mutual funds... all, in one place.

Every year, we publish the latest and exhaustive data on Top 300 companies. Plus, a wealth of information on over 20 sectors, the Indian economy, mutual funds... all, in one place.

This invaluable information serves as a ready-reckoner for any smart investor.

Available in an easy-access installable version and a PDF version as well, this Yearbook provides the latest data that could help you make smart investment decisions.

Priced at Rs 750 normally, you will get the 2015 Edition right away... Absolutely Free!

And guess what? The 2015 Yearbook is also an installable version.

So you can install it on your computer just once and get any information you need on the included companies with a few clicks of your mouse.

"How to Plan Your Equity Portfolio":

Our Hugely Popular Asset Allocation Guide

Now there is a very important thing you need to know while investing in stocks... And that is asset allocation.

Now there is a very important thing you need to know while investing in stocks... And that is asset allocation.

Asset allocation is the key to having a well diversified portfolio. It is what protects your investments and ensures their growth irrespective of the changes in the market.

A well diversified portfolio is one where your stocks are properly spread out across different market caps and different sectors.

Our extremely popular asset allocation guide will help you understand the ideal mix of stocks in your portfolio, so that you can minimize your losses and maximize your small cap returns.

And you can get this guide absolutely FREE when you subscribe to Hidden Treasure now.

Portfolio Tracker

The Portfolio Tracker is an online utility that helps you track all your equity and mutual fund investments in one place! It's online, and is available to you 24 hrs a day.

You just have to enter the details of stocks or mutual funds owned by you ONCE... and Portfolio Tracker will show you what your entire portfolio is worth AT THAT MOMENT anytime you log into it.

Furthermore...

- You can set your account to send you automatic end-of-week and end-of-month performance updates for all your portfolios.

- You can set up priced based alerts for all the stocks that you own (and also the stocks that don't own but only wish to track).

- Plus, now you can also track your short-term equity or derivative trades, SIPs and even get NAV alerts for the mutual fund schemes with Portfolio Tracker

But what makes the Portfolio Tracker the indispensable tool that it is are the “intelligent reports" that come along with it.

You see, we at Equitymaster have spent a considerable amount of time trying to understand how the fund managers who invest for the long-term track and review their portfolios.

And it is the relevant learnings from this exercise that we have translated into reports.

So you can now also generate customized intelligent reports for your stocks or portfolio, to understand how a certain market event could affect them.

We believe this feature is what sets Equitymaster's Portfolio Tracker apart from all the other trackers out there.

And the Portfolio Tracker usually costs Rs 330 for a year. But by subscribing to Hidden Treasure, you get it absolutely FREE.

What's more, the Portfolio Tracker can also be accessed on your mobile now.

Yes! And you don't need to install anything on your mobile too. Just go to our mobile site and access the Portfolio Tracker with ease.

Free subscription to

The Daily Reckoning . . .

Now you can read what knowledgeable investors across the globe read every single day for global market analysis and investment ideas.

Yes, we are delighted to bring you 'The Daily Reckoning', a daily financial e-column by Bill Bonner, Publisher and Editor, and three-time New York Times best-selling author.

The Daily Reckoning is published every day in 3 languages from offices in 6 countries - US, UK, Australia, France, Germany, South Africa.

Now, it's India's turn... and your turn to get it for FREE!

The Daily Reckoning is also published in India and is authored by Vivek Kaul.

Vivek is a writer who has worked at senior positions with the Daily News and Analysis (DNA) and The Economic Times, in the past. He has just finished writing a trilogy on the history of money and the financial crisis. The series is titled Easy Money. His writing has also appeared in The Times of India, Business Standard, Business Today, The Hindu and The Hindu Business Line.

Vivek is a writer who has worked at senior positions with the Daily News and Analysis (DNA) and The Economic Times, in the past. He has just finished writing a trilogy on the history of money and the financial crisis. The series is titled Easy Money. His writing has also appeared in The Times of India, Business Standard, Business Today, The Hindu and The Hindu Business Line.

If you're someone who's interested in investing in or even monitoring in the happenings in the global as well as Indian markets, you'll find the Daily Reckoning extremely useful.

And last but not the least...

The Equitymaster Research Digest

In case you're wondering how you're going to keep track of ALL the research we publish through Hidden Treasure...

You'll be glad to know that we now release a weekly email titled “The Equitymaster Research Digest" which gives you a roundup of all the research published under different services relevant to you during the week.

Yes, so you never have to worry about missing any of our recommendations and any other updates with respect to those services.

However, the Research Digest isn't just about compiling everything in one place...

We believe that an informed investor always manages to grow his wealth better than an uninformed investor.

That's why we also use the Research Digest as a medium to educate you on what's happening in the broader markets and other assets like gold, commodities, etc. too.

This helps you fine-tune your strategy in line with the economic climate at that time, unlike uninformed and unaware investors who are almost always one step behind.

Then if we've met any companies lately, or if there's some interesting discussion going on within our research team with regard to some company, we also tell you about it in the Research Digest.

And last but not the least in the Research Digest, we also regularly discuss the letters we've received from our readers or subscribers in the past one week.

And no matter those letters were of praise or criticism, we never shy away from talking about them and explaining our side of the story to you.

Here's what some subscribers had to say about the Research Digest...

So again, you'll never have to worry about missing any important research from Hidden Treasure or any of our other services you're subscribed to.

You can just click on a link in your email, and get the full information whenever you want.

And You Can Get All This At More Than 60% Off. . .

For Just Rs 1,950!

A year's subscription to Hidden Treasure usually costs Rs 5,000. But if you act now, we will give you your Hidden Treasure subscription for Rs 1,950 only.

This is More than 60% Off on the normal price!

Seriously, Rs 1,950 is probably way less than what you spend on all the phone calls to your broker, the money you pay to watch the noise on your television, and all the newspapers and magazines you buy hoping to find good investment opportunities.

And none of these other things can provide you unbiased and reliable small cap recommendations like Hidden Treasure.

But with a subscription to Hidden Treasure, you can be rest assured that whenever we come across little known, high potential small companies, we will notify you of them right away.

Here's what two of our subscribers had to say about Hidden Treasure...

And now, meet the brain behind

Hidden Treasure. . .

If you remember, I told you before how uncovering hidden and reliable small caps is a very difficult task.

If you remember, I told you before how uncovering hidden and reliable small caps is a very difficult task.

You are first required to do back-breaking research on various companies in the small cap sphere. And then, also traverse the length and breadth of the country to meet with the people in charge personally.

Richa Agarwal, Research Analyst and also the Managing Editor of Hidden Treasure, along with her team meets dozens of managements face to face every year.

And this is after pouring through the data and details of hundreds of small companies.

Having degrees in both finance as well as engineering has helped Richa greatly in picking the most deserving candidates for small cap service, and analyzing their business models and associated risks.

You see, Richa believes that paying a slight premium for wide-moat companies is better than looking for cheap bargains that sometimes turn out to be value-traps.

It is filters like these that have helped Richa and her team zero in on companies like Page Industries and e-Clerx much before they became well-known entities.

And made Hidden Treasure an extremely popular service with subscribers.

As the Managing Editor of Hidden Treasure, Richa constantly scours the small cap universe for fundamentally strong small companies trading at a discount.

And if she comes across any attractive looking companies, she and her team do further diligence on them and recommend them to you only when they have ascertained that everything's good.

But despite all this,

I have to warn you about something. . .

There are some cases in which Hidden Treasure and small caps may NOT be right for you.

For instance, if you're nearing retirement or have already retired, I don't recommend putting all of your retirement money into small caps.

Small caps are for those who are ready to take some risk to make big returns.

While you can make a lot of money from small caps, you can also lose a lot of it very quickly.

Just one good small cap stock could be enough to make you very rich. But to find that one small cap stock, you might have to go through a few duds as well.

Therefore every small cap investor needs to understand this and plan his or her small cap investments wisely.

And that's what Hidden Treasure can help you with!

Test-drive Hidden Treasure for 30 days

and then decide. . .

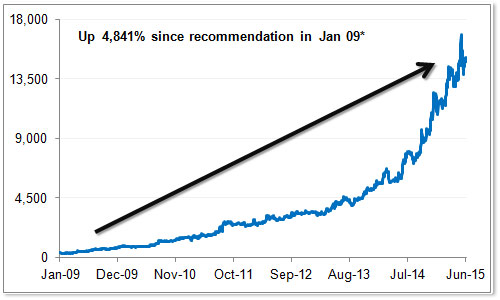

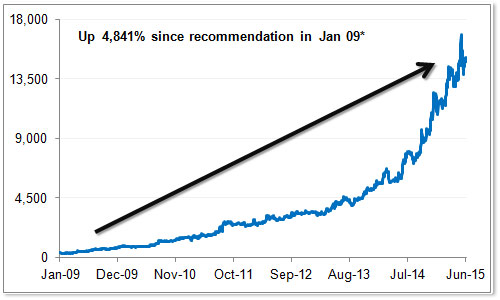

We had sent our subscribers a recommendation to invest in Page Industries on 15th January 2009.

Page Industuries Past performance does not guarantee future results.

Past performance does not guarantee future results.

*Returns have been calculated with respect to 30th June 2015

Past performance does not guarantee future results.

Past performance does not guarantee future results.*Returns have been calculated with respect to 30th June 2015

So far, this stock has given a return of 4,841% in 6 Years 5 months.

And it's still not closed!

So if you had invested just Rs 10,000 in this stock when we recommended it, your investment would be worth Rs 449,200 now and still going strong!

This is the money-making potential of small caps that the Hidden Treasure wants to help you tap!

So the price of Hidden Treasure should not be an issue anymore. And like I already said, you can try Hidden Treasure without any risk for a full 30 days.

If it turns out that you don't like it, just let us know before the 31st day and we'll refund the entire fee you paid. No questions asked!

Sounds good?

In any case, I suggest you act fast because...

- The volume of small cap shares traded is usually very low, so getting in early can make a difference. By subscribing to Hidden Treasure now, you get that advantage.

- Through this offer you can get 1 Year of Hidden Treasure for just Rs 1,950 instead of the usual Rs 5,000... which will be the case till for the next few days only.

So don't squander this opportunity...

This offer will close soon.